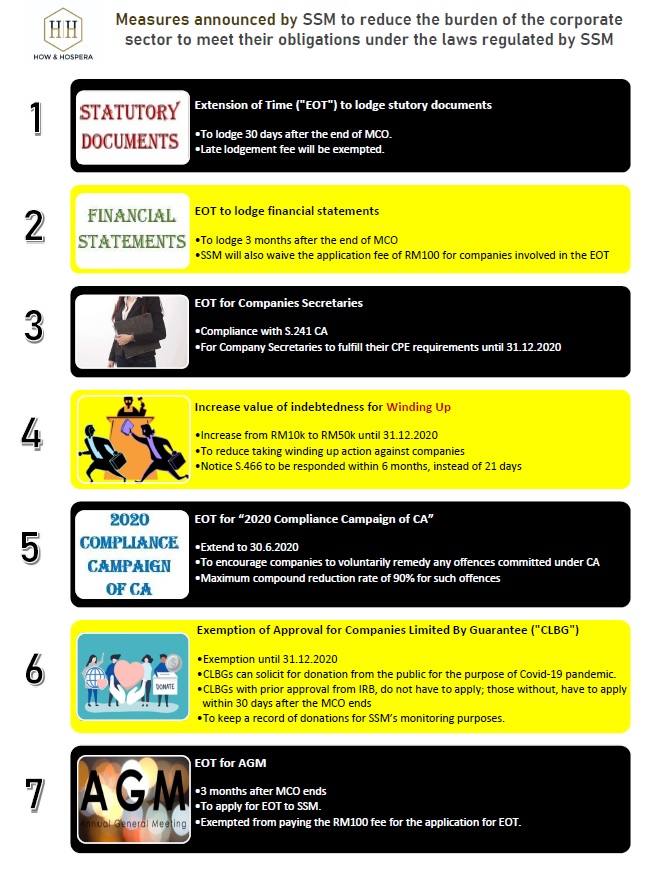

Recently, there are 7 measures announced by SSM to reduce the burden of the corporate sector to meet their obligations under the laws regulated by SSM. The announcement is found at https://www.ssm.com.my/Pages/Announcement-Covid19.aspx. One of them is in relation to the process of winding up against companies.

Pursuant to the said announcement, these are the changes made to the process of winding up: -

(1)Value of indebtedness

Presently, the value of indebtedness is set at the sum RM10,000.00. It means that a creditor would be able to file a winding up petition against a debtor (company), if the debtor is unable to pay its debts amounting to RM10,000.00.

On 10.4.2020, YB. DATUK ALEXANDER NANTA LINGGI, Minister of Domestic Trade and Consumer Affairs (KPDNHEP) announced that the current indebtedness threshold is no longer RM10,000.00, but increased to RM50,000.00, until 31.12.2020.

(2)Period to respond to a statutory notice of demand

Before a winding up petition could be filed, it is pertinent to note that a statutory notice of demand shall be sent to the debtor. The creditor could only file in its winding up petition after the lapsed of 21 days. The 21 days are given for the debtor to respond to the said notice. The period to respond to a statutory notice of demand has been lengthened from 21 days to 6 months.

It means that the creditor is only allowed to wind up a company if the company is owing a minimum sum of RM50,000.00, and the winding up petition could only be filed 6 months after the date of the statutory notice of demand.

The rationale behind the changes is to assist company affected by the COVID-19 pandemic to restructure and stabilise the financial flow of the company during the said 6 months’ period and may avoid the company from facing a winding up action in Court.

The above will not affect the winding up petition that has been filed in Court. We shall proceed to serve, advertise, gazette, and do the needful to obtain a winding up order in due course. For new matters concerning this issue, it is best for the creditor to take note of the above, and contact us at Alamat emel ini dilindungi dari Spambot. Anda perlu hidupkan JavaScript untuk melihatnya. should you need any further information.

DISCLAIMER:

1. This update is intended for your general information only. It is not intended to be nor should it be regarded as or relied upon as legal advice. You should consult a qualified legal professional before taking any action or omitting to take action in relation to matters discussed herein

2. You are free to reproduce or republish the contents of this website in any media, provided that it is expressly stated that the content was “originally published on howhospera.com.my” and contains a link back to the original post on this website.